It’s Been a Decade of AI in the Drug Discovery Race. What’s Next?

The year 2012 is often regarded as the beginning of the deep learning revolution.

That year, Alexnet, the deep learning model proposed in the research paper Imagenet Classification with Deep Convolutional Neural Network by Alex Krizhevsky and his colleagues, won the large-scale visual recognition challenge ImageNet -- completely dominating over other machine learning competitors.

Another famous event of that year was spontaneous identification of a cat by another deep neural network -- in millions of random YouTube videos.

Scientists at Google's mysterious X lab built a neural network of 16,000 computer processors with one billion connections, and it was never told to look for cats, nor was it told what a cat was. Artificial intelligence learned that by itself and flagged the pattern of pixels corresponding to a cat’s face.

While the concept of deep learning was known since the 1960s, the technology only started manifesting itself as a practically viable thing in the 2010s, mainly due to sufficient progress in computational power allowing it to train such complex models.

Additionally, 2000-2010s were marked by the increasing availability of big datasets for training purposes, such as ImageNet, and the rise of computational infrastructure, like Elastic Compute Cloud by Amazon -- other important drivers of the deep learning revolution which started unfolding in 2010-2012.

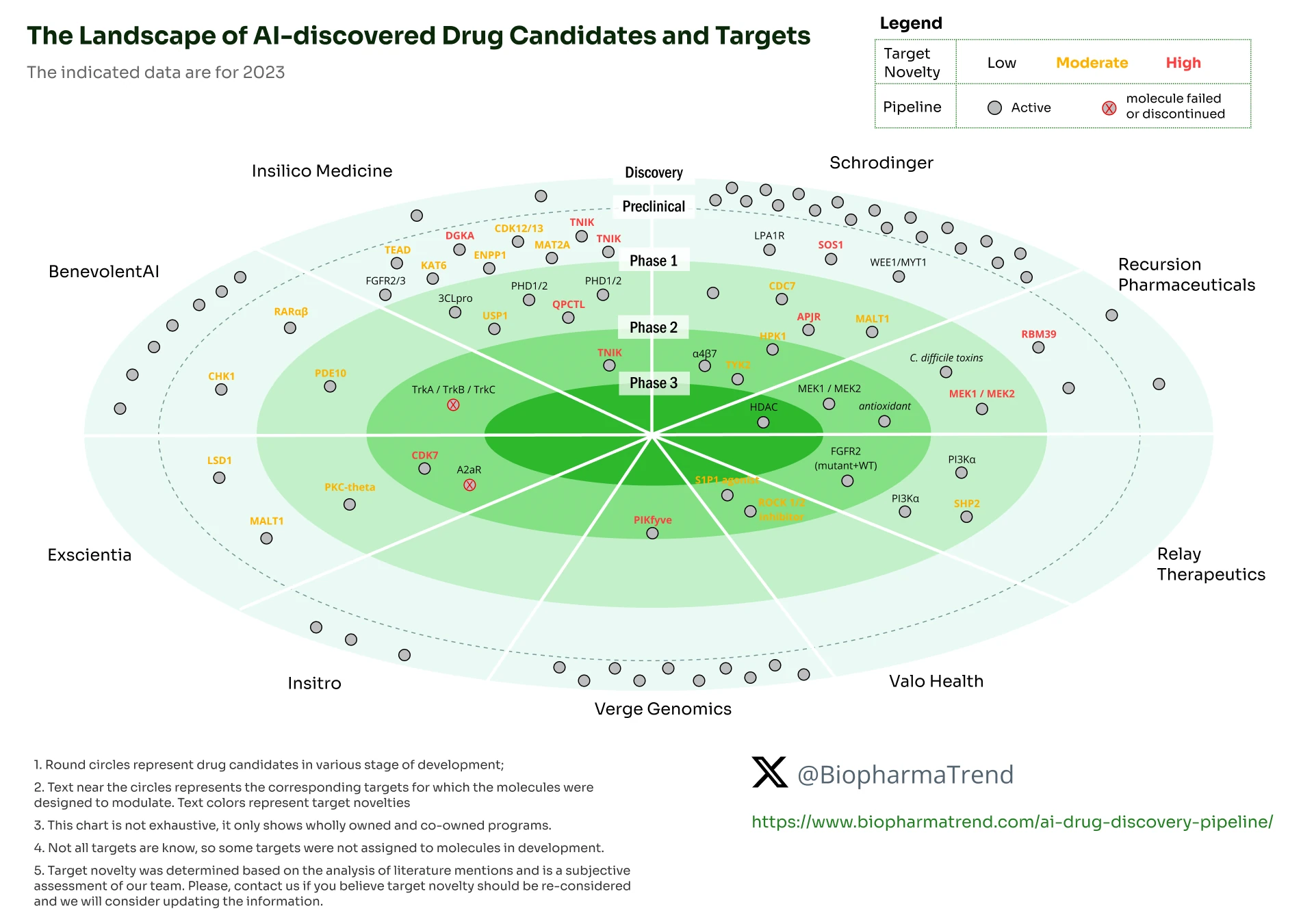

The drug pipeline progress of some of the leading AI in drug discovery companies over the years. See below for details.